Banks usually find it difficult to approve loans and credit facilities to clients who possess an unimpressive financial statement but BadCreditLoans.com are here with a turnaround in circumstances.

The main factor that usually determines whether your loan/request gets approved is basically financial credit history and anyone with an unimpressive history might find it arduous getting a credit loan. But there are other platforms that cater to the needs of individuals with bad credits. One of these includes BadCreditLoans.com.

Click Here to View Bad Credit Loans

BadCreditLoans.com Overview

BadCreditLoans.com is neither a bank nor a credit facility provider but a platform where a large number of financial institution and individuals who provide credit loans meet with credit seekers. There are various loan types available on the network ranging from mortgage loans to medical loans while not excluding auto loans and academic loans.

Usually, it is those situations beyond your grasp that tarnish your credit value which most credit providers might not take into consideration and thus refuse your credit request based on your credibility value. Most credit providers do not consider that low credibility ratings might not be a result of a circumstance within your grasp.

What are Bad Credit Loans?

Their objective and watchword remain “We Can Help When Others Can’t”. Though not credit providers, they provide an avenue to enable credit seekers to link up with a wide array of loan facilities and providers for low-period loans as much as $5,000. Designed with credit seekers with unimpressive credibility status, the entire procedure is fast-paced and is done solely on the internet.

Upon successful completion of the credit process, feedback is given over a short period of time whether there is a credit approval or not. The repayment period ranges as low as 3months and can be extended to a period of 3 years which can easily be carried out via the Bad Credit Loan Network.

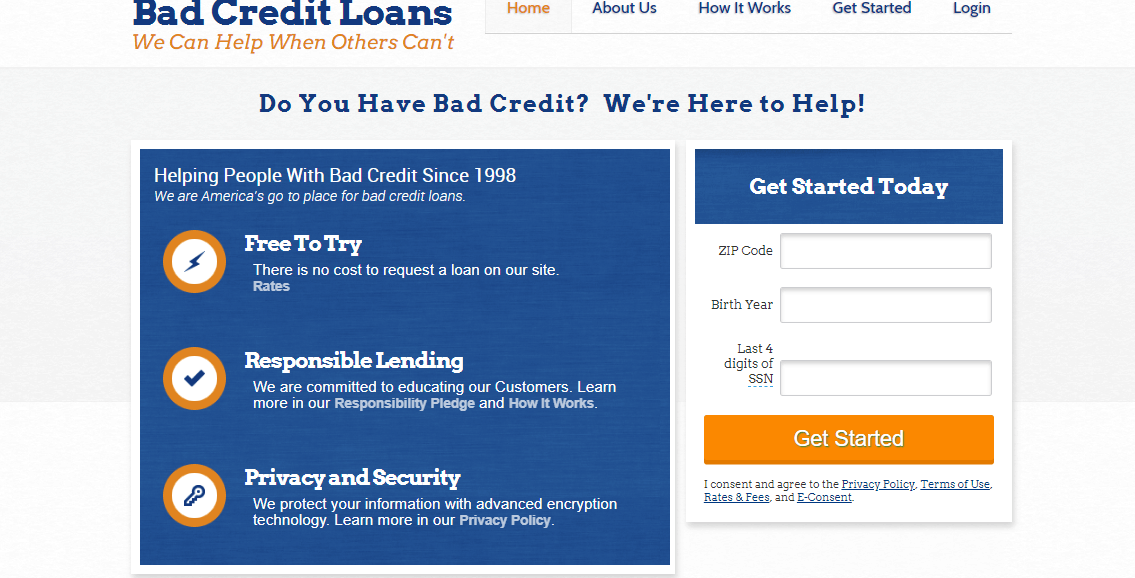

As far back in 1998, BadCreditLoans.com has been the ‘go-to place for loan seekers who possess an unimpressive credibility status. The entire service is free even when your loan is approved but you decide not to go through with it, there are zero sanctions. And if you decide to go through with your loan after approval, they are on the ground to talk through the conditions with you in full before you append your signature thus protecting both lender and borrower!

Although the huge interests associated with loans might be a drawback, the fact that BadCreditLoans.com offer loans

- That is free and holds you under no charge; while also

- Practicing responsible lending and

- Extremely confidential in nature; these are all perks you cannot find with bad credit status.

Bad Credit Loans’ accountability

Chief LLC, a Limited Liability company not situated in Nevada operates BadCreditLoans.com according to their website. You can find a profile for Bad Credit Loans at Better Business Bureau (BBB) although a search of “Chief LLC” might not turn up a probable outcome. A click on the Contact tab at BadCreditLoans.com places their address at 2661 N. Pearl St. #431, Tacoma, WA 98407 while their email and phone number are listed as support@badcreditloans.com or 1-800-245-5626.

What does Bad Credit Loan do and how?

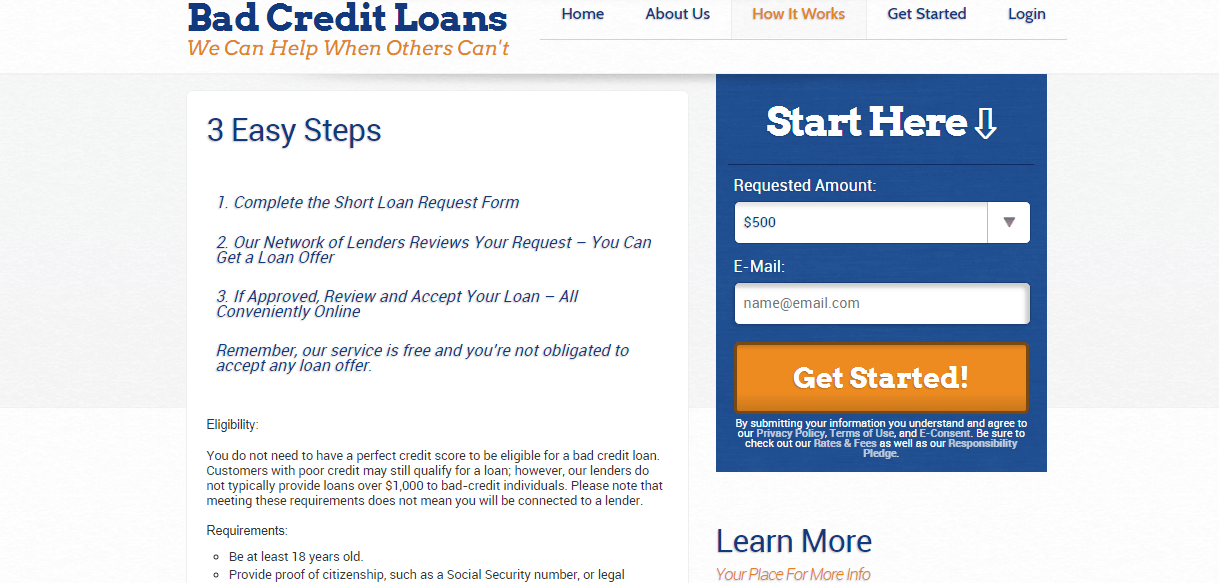

When you possess low credibility status and there is an emergency situation with financial involvement to cater for, BadCreditLoans.com is where you can get a cash loan fast. Though they do not lend you the money, they bring offers that fit your needs from credit providers. Loan requests can be made at any time of the day as the company accepts everyone and anyone irrespective of the credit rating. A Survey of short-term offers can be done free of charge and at no mandate.

The procedure of loan application is easy. All you need do is fill out the loan application form and you get offer(s) from the company’s pool of loan providers in just a couple of minutes. Upon loan approval, your checking account will be credited with the loan amount in as soon as 24hours via the electronic banking system. No need to be anxious about getting loan security or guarantor. State requirements vary, and you may not be eligible depending on your residence location.

What Is the legal backing for BadCreditLoans.com?

BadCreditLoans.com is a lawful internet platform that has been networking credit seekers with lenders irrespective of credit rating since 1998. However, always ensure to compare credit providers and their interest rates to confirm if the deal is solely the best for you ever before appending your signature. This is sole because short-term loan laws are constantly changing alongside the state regulations about them. There exists limitations in regard to fees and charges in relation to the maximum loan amount and lawmakers usually keep up-to-date with these regulations in order to protect the borrower.

Is it safe to apply for a loan via BadCreditLoans.com?

BadCreditLoans.com goes through painstaking efforts to ensure your financial and personal data are secure when you apply on their website.

After imputing your data on BadCreditLoans.com, you consent to let them make such information available to credit providers available on their platform who may then decide to contact you with their offers via fax, phone calls, or postal mails.

Do ensure to go through their privacy policy to fully understand how it works. In case your mind your information being shared wide a wide array of lenders, applying with a direct lender might be a better option for you.

Why consider BadCreditLoans.com?

- There is no approval fee charged by the platform. Filling and submission of the application are entirely free although the lender you choose might charge extra fees, do ensure to read through the terms before appending your signature.

- Loan approval can be gotten almost as soon as you apply.

- com protects all your data using highly secure techniques.

- Your account can be credited with the approved loan sum as fast as 24 business hours.

What to Check For

Although BadCreditLoans.com is a trusted broker that connects lenders with a borrower, it is important that one examine the terms and conditions from the lender that one will eventually work with.

This is what one should take note of:

- Huge Interest rates: Although BadCreditLoans.com reports that its lenders give APRs of about 35.99%, some payday loan giver do have interest rates of more than 1,200%

- High fees: Cash advances could be up to hundreds of dollars in fees, compared to the main and original cost of the loan

- Risk of debt Spiral: Short-term loans should be considered as a last resort. On taking a loan that you do not have the capacity to repay, you will have to roll over or refinance the amount left

- Your Data Could be sold as a lead: Brokers could give out your information to other lenders for a price. Thus, this can make your lead to be sold well after you apply with a broker.

Pew Charitable Trusts reports that yearly, almost 12 million Americans go for short-term loans. People also love to do repeat borrowing. This has caught the interest of companies by luring customers with incentives for regular borrowing.

Prompt payment of any loan is very important. Inability to pay in time, in full could cause damage to your credit due to additional fees.

What fees does BadCreditLoans.com charge?

You will not be charged for applying for a loan via BadCreditLoans.com. Although, your chosen loan provider could add a finance fee together with the huge interest rates. Thus, we recommend that you examine the charge of the loan before signing a loan offer document, together with the loan offer document. Together with the term of the loan, the document presents any punishment charges and fees that must be paid.

If you feel the fees are too much, you can reject the contract.

Some facts about the BadCreditLoans.com

- Terms and Worth of the Loan: You can seek a loan from $500 to $5,000. The duration goes from 3 to 60 months.

- Not a Direct Lender: BadCreditLoans.com only joins customers with trusted leaders in the network. It is not a direct lender.

- Simple Qualifications: the qualification of BadCreditLoans.com is pretty simple. Thus, applicants who were not approved in other places will have access to a short-term loan.

- APR: From one of its lender partners, a short-term loan has its APR which goes from 5.99%. The lenders in the various networks are different in terms of what they offer. They will also determine the interest rate on the loan based on some factors. One can choose any repayment plans that suit the need.

- E-Consent: The Company gives the capacity to make available e-signature for loan agreements, disclosures, and records.

- Comfortable Web page: The Website is available 24/7.

How to Apply

It is pretty easy to apply online; applicants, however, have to meet the following requirements:

- Be a citizen of America or a permanent resident of the United State

- Be 18 years and above

- Must have a regular source of income

- Must possess a checking account in your name.

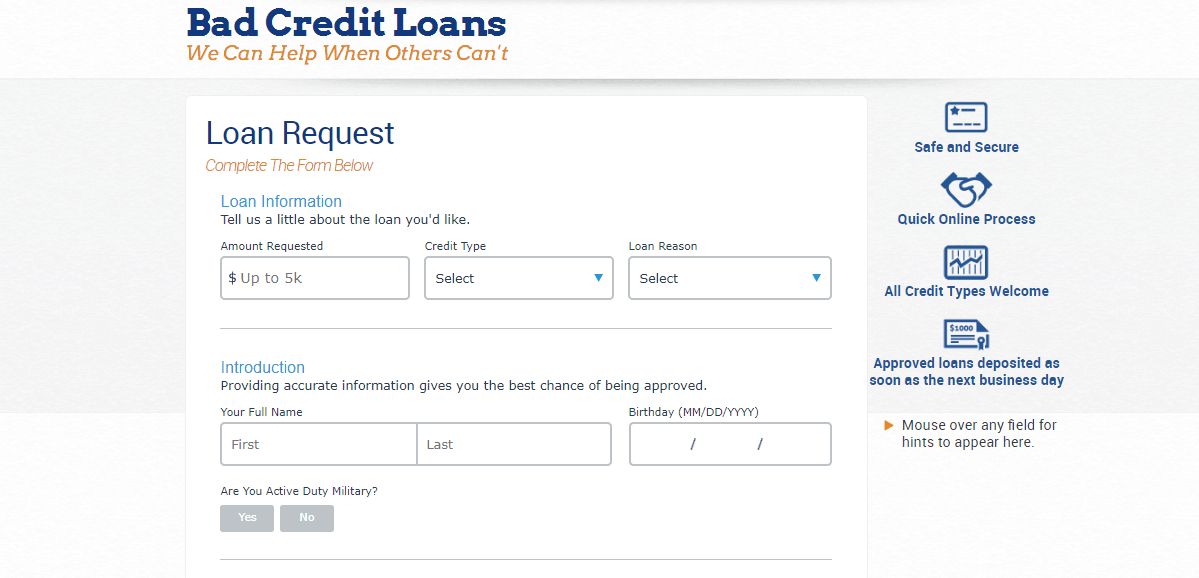

The entire application is online and needs the following data for documentation:

- The complete full name, contact info, date of birth with the Social Security number.

- The type of credit, loan amount, and the reason for the loan

- Information from an ID Card like a passport or driver’s license

- Information on the bank account

- Annual income information and the employment

The Loan Process

To get a loan from BadCreditLoans.com, borrowers will give out the standard info stated in the eligibility requirement. On submitting the loan application, Bad credit Loan gives your application to many lenders that can either grant or deny your request. If your request is granted, your loan request will be examined critically and lenders will ask for your credit score via credit bureaus which could impact your credit score.

On the approval of your credit info, one could get more than one loan offers depending on the lender that approves the request, After that, you can examine the terms of the loan like the fees, the interest rate as well as other cogent information that should be examined before accepting the loan offer.

Process for Repayment

When the borrower agrees to the stated terms of the loan by the lender, the loan agreement must be signed online with an e signature. Upon signing and submission, the loan funds will be forwarded to the checking accounts provided via the loan application process. Through direct deposit, it takes between one and three days to arrive. The repayment period usually goes from 3 to 36 months, depending on the terms of the loan. It also comes with high Annual percentage rates between 5.99% and 35.99%

Should there be any question regarding the loan, BadCreditLoans.com advises borrowers to get in touch with the lender directly. Also, worthy of note is that there are huge fees for late-payments and for borrowers who miss a payment. The loans could go to correction which might affect the credit.

Community feedback

Consumer reviews concerning Bad Credit Loans is somewhat controversial when going through their profile at the Better Business Bureau. There are complaints like mid-theft of funds, illegal loan application without borrower knowledge, etc are among the top complaint concerning the Bad Credit Loans. Some old reviews at, however, gave positive user experience from people who were grateful to have access to the loan they required via bad credit Loans.

Is Bad Credit Loans Trustworthy?

BadCreditLoans.com stays in the middle of the trust circle. Their operation is somewhat reliable. It, however, is not the best loan provider. If you, however, consider the long record of Bad Credit Loans, as well as the fact that they have existed for a little more than 20 years, we are confident that Bad Credit Loans is pretty trustworthy as at 2018

Popularity

Among the most common lending destination that has a web global rank of 57,270 and a US rank of 10,474, BadCreditLoans.com is quite popular. This data is as of January 12th, 2018. More than 94% of the traffic to the site comes from people staying in the US. And also, more than 50% of the site traffic comes from email and referral sources.

Click Here to View Bad Credit Loans

Bad Credit Loans Conclusion

Without a doubt, Bad Credit Loans is one of the genuine innovators for delivering online loan services. Founded in 1998, BadCreditLoans.com has proved itself worthwhile for potential borrowers and has assisted quite a lot of people who needed a loan to get one on time. It supports up to .5 million visitors every month and is also growing in popularity. Without a doubt, Bad Credit Loans will continue to operate and rescue people from financial difficulty for many years.