1. Your significant other packs up all their stuff, taking with them their added income:

In other words, divorce. Divorce can be devastating both emotionally and financially and can affect both parties. In today’s world of divorce, there are diverse situations. For example, there are more single dads today where the father is awarded custody, and thus the primary caregiver. More divorced women today will end up paying the ex-husband palimony, and even parts of her retirement funds. Either way, divorce proceedings, and costs can land either party into bankruptcy court.

2. Car payments cost more than your mortgage:

Like the baseball player, Jack the Ripper”, (played 1975 – 1992) of Red Sox acclaim, having a car habit can be a problem to finances. Jack Clark ended up filing for bankruptcy after his purchase of 18 luxury cars. Ownership like this is unreasonable for most, but something is to be said about having a car habit.

- Do you own several cars that you don’t actually use?

- Would you rather spend a whole weekend buying up car parts instead of spending time or money with family?

- Do you find yourself pouring over vehicle auctions?

3. You’ve got no food in the pantry but you’re stylin’ Gucci:

It can be appealing to display wealth by wearing only name-brand designer clothing. However, a dangerous trend is buying so many clothing purchases, that the family doesn’t have enough food in their homes. The trend is having all Gucci, Louis Vuitton, Polo, and other high priced name brand clothing items. How to tell if you have a fashion obsession?

- No food in the cabinets nor pantry

- In your clothes closet, there are more items with name brand and very few items with a no-name or off-brand

Refusal to go to thrifting, because that ain’t your style

4. You have an episode and spend thousands of dollars at the mall, all of it at a retail cost:

Ok, so maybe we don’t have to have spending spree episodes, but spontaneous purchases can be costly. They can lead you to get broke quickly.

- Actually paying the full price

- Making purchases when hungry

- Making purchases in front of friends and showing off

- Forced technology upgrades

In our global market today, with ordering capabilities of goods via the internet and online apps, along with discounts, coupons, promo codes, etc. there’s really no reason to ever purchase anything at full retail ever again.

5. Home is out of range of the true bring-home income:

Even though the debt to income ratio looks good on paper, there are many hidden costs to owning a home. The realities of property ownership are what rack up costs.

- Taxes/ homeowner’s insurance costs

- Repair costs

- Keeping the home maintained and comfortably furnished

We can take a lesson learned from Mike Tyson. Even a person earning millions can overextend. He owned a $4.5 million dollar house and paid 400,000 per month, for its upkeep and ended filing for bankruptcy in 2003.

6. Shoe collection out of this world:

Like Jarret Jack (NY Knicks) basketball star, whose collection takes up 2000 cubic feet of closet space, people often have a collection that can be way overboard.

- Make a budget, which includes mortgage, car, and utility payments.

- Give yourself a cash allowance for small changes in the pocket.

- But don’t let that amount be as much as your smallest bill due.

- Stay on the budget and don’t spend outside the budget

- Know your weakness; write it in, but stay within that range.

7. Student loans haunt us for life: that is a THING!

Many college-educated graduates start out with the best intentions of getting a great job right out of college. But, more often than not, the great job dissipates into the cloud of reality and although the work may be good, perhaps the money isn’t quite what was promised. Often, there’s just not as much disposable income to pay back the educational loan right away. As tempting as may be, it can be helped, avoid forbearance or deferment. Because these loans are unlike credit card debt, you could end up paying interest on interest.

8. Medical costs if you have health insurance:

Regardless if you have health insurance, medical bills can make a person go broke. If you’re a small business owner, and don’t have a significant life partner who has a decent health insurance plan from their job, health care costs can be dangerous. This applies to the retiree as well. Either case, if not on board with Medicare, the Affordable Care Act, or some sort of government insurance plan, could end up overspending per month for medications or healthcare in the out-of-pocket expenses.

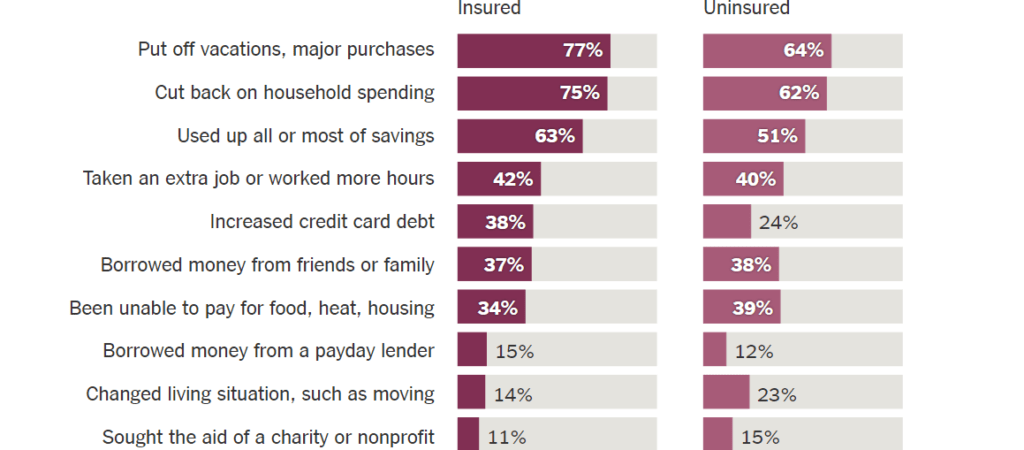

Medical Problems Lead to Financial Sacrifices

People who reported problems paying medical bills in the last year told pollsters they’d done the following:

Source: The New York Times and Kaiser Family Foundation survey

9. Having no healthcare insurance is a whole other way to go broke.

Since they pay directly out of pocket, they will actually spend less on health services especially earlier on in life. People used to think that hospitals have private funding sources, to cover for the uninsured. Not as much as before.

- Later in life, there are more end-stage diseases, but because it’s so late into the disease process, the individual becomes disabled.

- For the uninsured, health costs overall relative to their total bring-home income, is much higher. Because the cost is still way more out of their total income, they end up having less wealth toward the end of their lives, as compared to those with health insurance.

10. The midnight shopper using the internet or retailer.

Recently, QVC was picked as the 10th largest internet retailer and the third-largest mobile retailer in the Internet Retailer Magazine, 2016 top 500 picks. The trend is internet-based entertainment sources so the simplest extension of that is shoppable entertainment. The problem with this is how easy it is to shop for really anything, guilt-free. Worse is the midnight shopping. When the dust settles and it is morning again, there’s a genuine surprise at what’s been ordered.

Resources:

- Evans, Sean. April 15, 2013.The 25 Dumbest Athlete Purchases of All Time; retrieved on June 5, 2018, from https://www.complex.com/sports/2013/04/the-25-dumbest-athlete-purchases-in-history/darnell-docketts-alligator

- Sandomir, Richard. August 5, 2003. Tyson’s Bankruptcy Is a Lesson In Ways to Squander a Fortune. retrieved on June 5, 2018 from: https://www.nytimes.com/2003/08/05/ sports/tyson-s-bankruptcy-is-a-lesson-in-ways-to-squander-a-fortune.html#story-continues-1

- James, Shydel. April 13, 2012. Mike Tyson Decoded: How he Earned (and Squandered) a $300 Million Fortune; retrieved on June 6, 2018, from http://www.blackenterprise.com/mike-tyson-decoded-300-million-fortune-squandered/5/

- Sanger-Katz, Margot. January 5, 2013. NY Times in TheUpshot section associated with Public Health, “Even Insured Can Face Crushing Medical Debt, Study Finds” retrieved on June 6, 2018, from https://www.nytimes.com/2016/01/06/upshot/lost-jobs-houses-savings-even-insured-often-face-crushing-medical-debt.html

- Stanger, Tobie. June 27, 2016. Student Debt vs. Mortgage Debt; retrieved on June 4, 2018, from https://www.consumerreports.org/student-loan-debt-crisis/student-loans-vs-mortgages-what-makes-student-debt-different/

Institute of Medicine (US) Committee on the Consequences of Uninsurance. Hidden Costs, Values Lost: Uninsurance in America. Washington (DC): National Academies Press (US); 2003. 3, Spending on Health Care for Uninsured Americans: How Much, and Who Pays? Available from: https://www.ncbi.nlm.nih.gov/books/NBK221653/